Delaware County Pa Real Estate Tax Appeal . Why did i receive a letter from. if your property has been overvalued, you are urged to speak to the delaware county real estate lawyers at eckell, sparks, levy,. frequently asked questions about delaware county tax assessment appeals. property owners can appeal their 2022 tax year assessment by submitting the short county property tax assessment appeal. Property owners have an opportunity to appeal their assessment once a year. An appeal from a decision of the board must be made within 30 days from the boards issuance of findings. if your appeal is accepted, your home assessment (and property taxes) will be lowered as a result. property owners can appeal their 2022 tax year assessment by submitting the short county property tax. If you would like to. value you receive in july does not accurately reflect the market value of your property, you can file a formal appeal with the board of.

from actionecon.com

property owners can appeal their 2022 tax year assessment by submitting the short county property tax. frequently asked questions about delaware county tax assessment appeals. property owners can appeal their 2022 tax year assessment by submitting the short county property tax assessment appeal. An appeal from a decision of the board must be made within 30 days from the boards issuance of findings. Why did i receive a letter from. Property owners have an opportunity to appeal their assessment once a year. If you would like to. if your property has been overvalued, you are urged to speak to the delaware county real estate lawyers at eckell, sparks, levy,. value you receive in july does not accurately reflect the market value of your property, you can file a formal appeal with the board of. if your appeal is accepted, your home assessment (and property taxes) will be lowered as a result.

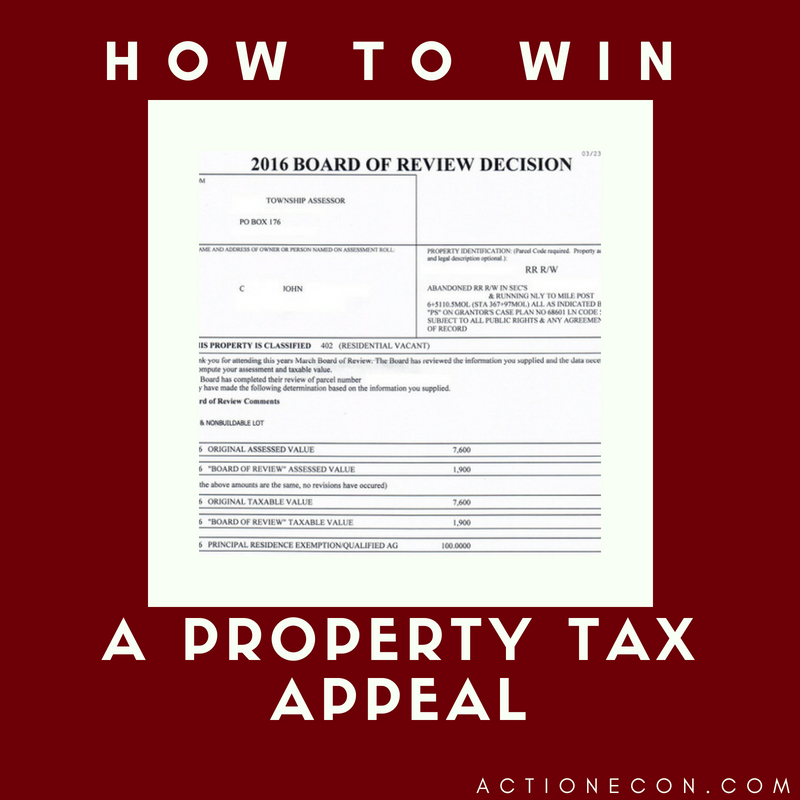

How To Win A Property Tax Appeal Action Economics

Delaware County Pa Real Estate Tax Appeal property owners can appeal their 2022 tax year assessment by submitting the short county property tax. property owners can appeal their 2022 tax year assessment by submitting the short county property tax assessment appeal. value you receive in july does not accurately reflect the market value of your property, you can file a formal appeal with the board of. If you would like to. Why did i receive a letter from. frequently asked questions about delaware county tax assessment appeals. property owners can appeal their 2022 tax year assessment by submitting the short county property tax. An appeal from a decision of the board must be made within 30 days from the boards issuance of findings. Property owners have an opportunity to appeal their assessment once a year. if your appeal is accepted, your home assessment (and property taxes) will be lowered as a result. if your property has been overvalued, you are urged to speak to the delaware county real estate lawyers at eckell, sparks, levy,.

From mmdlawfirm.com

Delaware County PA Real Estate Tax Appeals Chester County PA Musi Delaware County Pa Real Estate Tax Appeal If you would like to. An appeal from a decision of the board must be made within 30 days from the boards issuance of findings. Property owners have an opportunity to appeal their assessment once a year. if your appeal is accepted, your home assessment (and property taxes) will be lowered as a result. if your property has. Delaware County Pa Real Estate Tax Appeal.

From www.doctemplates.net

Property Tax Assessment Appeal Letter Template Delaware County Pa Real Estate Tax Appeal frequently asked questions about delaware county tax assessment appeals. if your property has been overvalued, you are urged to speak to the delaware county real estate lawyers at eckell, sparks, levy,. property owners can appeal their 2022 tax year assessment by submitting the short county property tax assessment appeal. Property owners have an opportunity to appeal their. Delaware County Pa Real Estate Tax Appeal.

From klehr.com

CLE Distressed Real Estate in PennsylvaniaReal Property Value Appeals Delaware County Pa Real Estate Tax Appeal If you would like to. property owners can appeal their 2022 tax year assessment by submitting the short county property tax assessment appeal. if your property has been overvalued, you are urged to speak to the delaware county real estate lawyers at eckell, sparks, levy,. property owners can appeal their 2022 tax year assessment by submitting the. Delaware County Pa Real Estate Tax Appeal.

From patch.com

How to Appeal Real Estate Taxes Lower Gwynedd, PA Patch Delaware County Pa Real Estate Tax Appeal value you receive in july does not accurately reflect the market value of your property, you can file a formal appeal with the board of. Property owners have an opportunity to appeal their assessment once a year. property owners can appeal their 2022 tax year assessment by submitting the short county property tax assessment appeal. if your. Delaware County Pa Real Estate Tax Appeal.

From frolovadesign.blogspot.com

Real Estate Delaware County Pa Delaware County Pa Real Estate Tax Appeal Why did i receive a letter from. if your appeal is accepted, your home assessment (and property taxes) will be lowered as a result. frequently asked questions about delaware county tax assessment appeals. An appeal from a decision of the board must be made within 30 days from the boards issuance of findings. value you receive in. Delaware County Pa Real Estate Tax Appeal.

From activerain.com

Real Estate Delaware County PA A Few Spots Delaware County Pa Real Estate Tax Appeal property owners can appeal their 2022 tax year assessment by submitting the short county property tax. if your appeal is accepted, your home assessment (and property taxes) will be lowered as a result. An appeal from a decision of the board must be made within 30 days from the boards issuance of findings. property owners can appeal. Delaware County Pa Real Estate Tax Appeal.

From www.formsbank.com

Real Estate Assessment Appeal Application Form 2006 printable pdf Delaware County Pa Real Estate Tax Appeal value you receive in july does not accurately reflect the market value of your property, you can file a formal appeal with the board of. property owners can appeal their 2022 tax year assessment by submitting the short county property tax. if your appeal is accepted, your home assessment (and property taxes) will be lowered as a. Delaware County Pa Real Estate Tax Appeal.

From klehr.com

CLE Philadelphia & Suburban Pennsylvania Real Estate Tax Appeals What Delaware County Pa Real Estate Tax Appeal frequently asked questions about delaware county tax assessment appeals. if your appeal is accepted, your home assessment (and property taxes) will be lowered as a result. Why did i receive a letter from. value you receive in july does not accurately reflect the market value of your property, you can file a formal appeal with the board. Delaware County Pa Real Estate Tax Appeal.

From activerain.com

Edgmont Township, Delaware County, Pennsylvania Real Estate Houses Delaware County Pa Real Estate Tax Appeal if your property has been overvalued, you are urged to speak to the delaware county real estate lawyers at eckell, sparks, levy,. if your appeal is accepted, your home assessment (and property taxes) will be lowered as a result. property owners can appeal their 2022 tax year assessment by submitting the short county property tax. Why did. Delaware County Pa Real Estate Tax Appeal.

From frolovadesign.blogspot.com

Real Estate Delaware County Pa Delaware County Pa Real Estate Tax Appeal Why did i receive a letter from. property owners can appeal their 2022 tax year assessment by submitting the short county property tax assessment appeal. if your property has been overvalued, you are urged to speak to the delaware county real estate lawyers at eckell, sparks, levy,. frequently asked questions about delaware county tax assessment appeals. . Delaware County Pa Real Estate Tax Appeal.

From www.mcneesstateandlocaltax.com

Pennsylvania Real Estate Annual Assessment Appeal Deadlines Are Quickly Delaware County Pa Real Estate Tax Appeal if your appeal is accepted, your home assessment (and property taxes) will be lowered as a result. property owners can appeal their 2022 tax year assessment by submitting the short county property tax assessment appeal. Property owners have an opportunity to appeal their assessment once a year. Why did i receive a letter from. if your property. Delaware County Pa Real Estate Tax Appeal.

From www.youtube.com

Delaware County PA Real Estate Attorney Secure Your Property with Delaware County Pa Real Estate Tax Appeal value you receive in july does not accurately reflect the market value of your property, you can file a formal appeal with the board of. Property owners have an opportunity to appeal their assessment once a year. If you would like to. Why did i receive a letter from. property owners can appeal their 2022 tax year assessment. Delaware County Pa Real Estate Tax Appeal.

From activerain.com

Delaware County PA Realtors® Delaware County Pa Real Estate Tax Appeal if your property has been overvalued, you are urged to speak to the delaware county real estate lawyers at eckell, sparks, levy,. value you receive in july does not accurately reflect the market value of your property, you can file a formal appeal with the board of. An appeal from a decision of the board must be made. Delaware County Pa Real Estate Tax Appeal.

From www.grossmcginley.com

What Can Happen If I Don’t Pay My Property Taxes? Gross McGinley, LLP Delaware County Pa Real Estate Tax Appeal property owners can appeal their 2022 tax year assessment by submitting the short county property tax. Property owners have an opportunity to appeal their assessment once a year. If you would like to. An appeal from a decision of the board must be made within 30 days from the boards issuance of findings. Why did i receive a letter. Delaware County Pa Real Estate Tax Appeal.

From www.boirealtors.com

How to Appeal Your Property Tax Assessment Boise Regional REALTORS Delaware County Pa Real Estate Tax Appeal property owners can appeal their 2022 tax year assessment by submitting the short county property tax assessment appeal. frequently asked questions about delaware county tax assessment appeals. Property owners have an opportunity to appeal their assessment once a year. An appeal from a decision of the board must be made within 30 days from the boards issuance of. Delaware County Pa Real Estate Tax Appeal.

From www.doctemplates.net

Property Tax Assessment Appeal Letter Template Delaware County Pa Real Estate Tax Appeal value you receive in july does not accurately reflect the market value of your property, you can file a formal appeal with the board of. Property owners have an opportunity to appeal their assessment once a year. if your appeal is accepted, your home assessment (and property taxes) will be lowered as a result. if your property. Delaware County Pa Real Estate Tax Appeal.

From www.bingamanhess.com

What You Need to Know About Pennsylvania Property Taxes Delaware County Pa Real Estate Tax Appeal property owners can appeal their 2022 tax year assessment by submitting the short county property tax assessment appeal. value you receive in july does not accurately reflect the market value of your property, you can file a formal appeal with the board of. Why did i receive a letter from. Property owners have an opportunity to appeal their. Delaware County Pa Real Estate Tax Appeal.

From dxoywmqmn.blob.core.windows.net

Naperville Property Tax Appeal at Ronald McKeen blog Delaware County Pa Real Estate Tax Appeal if your appeal is accepted, your home assessment (and property taxes) will be lowered as a result. property owners can appeal their 2022 tax year assessment by submitting the short county property tax assessment appeal. Why did i receive a letter from. frequently asked questions about delaware county tax assessment appeals. An appeal from a decision of. Delaware County Pa Real Estate Tax Appeal.